In the film business, opening weekend is the critical barometer: a movie’s receipts from the first couple of days typically predict how popular it will be at the box office. That dynamic holds true in the biopharma industry as well. A product’s performance during its launch often indicates how successful it will be during its life cycle.

Effectively launching a new biopharma product, however, has never been more challenging. In addition to a litany of regulatory issues, companies face high stakeholder expectations, numerous market-access hurdles, and stiff competition, all of which are made more formidable by the business realities of the industry: pipelines are boasting fewer promising candidates than they did only a few years ago, and many are not true breakthroughs.

In the past, companies had an abundance of potential therapies in R&D, and they could count on a continuous flow of new products. Some were revolutionary drugs, but all were virtually guaranteed market access. This is not the case today. Pipelines are thinner, and blockbusters are fewer. In addition, facing both an explosion in medical costs and constrained budgets, national payers in most European countries, and a host of private insurers in the U.S., are increasingly unwilling to pay for marginal innovation in categories that are well served by existing products. More often, market access is coming with heightened reimbursement restrictions.

In this uncertain environment, companies are increasingly focusing on their launch strategy. Typically, launch managers use their estimates of peak sales to determine investment levels, resource allocations, and manufacturing plans. Yet the industry has a poor track record of predicting a product’s performance. We followed the sales development of a group of products that were launched from 1994 through 1997 and found that company estimates of peak sales at launch were not predictive of peak sales reached during the products’ life cycles.

In fact, the correlation between estimated and realized peak sales was close to zero. In addition, we analyzed data from EvaluatePharma and discovered that the peak sales for new treatments introduced from 2001 through 2005 averaged $950 million per year; however, this number dropped to $570 million in the second half of the decade. Specifically for drugs launched in 2008, only 33 percent were expected to achieve peak annual sales of more than $1 billion. And looking ahead to 2013, no forthcoming drugs are projected to post peak sales in excess of $750 million.

Pipelines are thinner, and blockbusters are fewer

Still, company valuations are highly dependent on the potential of the product pipeline. Therefore, the cost of failing to successfully launch a product is high. Clearly, companies cannot continue to roll out therapies as they have done in the past. Not only is the environment more complex but also the traditional guidelines no longer apply. With fewer therapies under development, realizing the full potential of every product is critical to a company’s health and, in some cases, its survival. Therefore, it is more important than ever for companies to pursue a more sophisticated launch strategy.

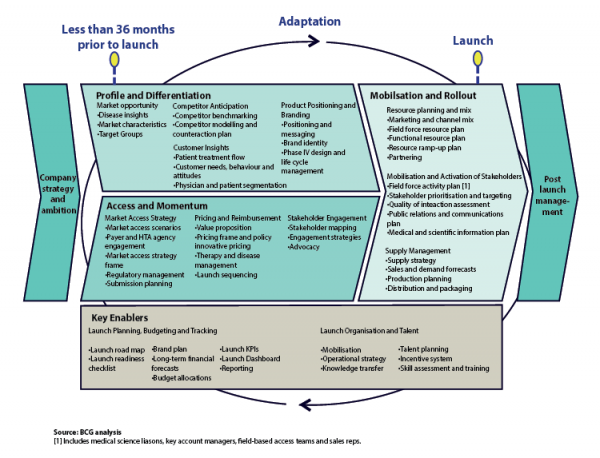

Traditionally, companies have built launches almost solely around promoting a product’s efficacy and safety to physicians. But this is no longer enough. Rather, companies must take a comprehensive approach—one that includes more precisely differentiating the product from the competition, devising an effective strategy for winning market access, performing timely market research, and mobilizing the company around the effort. Because all these tasks are interconnected, and the marketing environment is complex and shifting, planning is often what distinguishes the successes from the failures. Much of the groundwork for a successful launch must be laid 24 months or more before the therapy receives approval. So to assist companies in their planning, we have identified six levers that launch managers should pull to create a winning rollout.

Create a Winning Playbook

Much like an athlete or a coach, launch managers need to think strategically if they are going to lead their team to victory. This is a critical departure from the more static approach, which takes into account market conditions, how much companies have spent to support a competing product, and how they have positioned their product – at a particular point in time. Considering only competitors’ past actions leaves managers ill-prepared to react to changes in rivals’ tactics. Instead, launch managers must plan for the “game” that lies ahead – anticipating the successive moves that competitors might make in the face of a new market entrant.

War-gaming can be an effective tool to identify possible market disruptions, study the probability of various competitive actions and estimate their impact, and design an appropriate response.

War-gaming can be an effective tool to identify possible market disruptions, study the probability of various competitive actions and estimate their impact

It can also be used to prepare for rivals’ product launches. For example, The Boston Consulting Group used war-gaming to help a company with an injectable biologic product prepare for the launch of competing products. Among the key unknowns were the products’ pricing and labeling. We created four possible scenarios on the basis of these unknowns and had teams play out how they would respond in each situation. This exercise identified important vulnerabilities and led to a plan for addressing them, which is expected to protect about $100 million in annual revenue from sales of the biologic product.

Put Market Access Front and Center

For many in the industry, winning in the marketplace has been achieved by having sales representatives continually communicating information about a product’s efficacy and safety directly to physicians. In today’s world, biopharma companies need to effectively make the case for their product to a host of payers and health technology assessment (HTA) agencies, which are now operating in most markets. In discussions with BCG, industry experts revealed that payers and HTA agencies have the most influence over a product’s performance in the market, sometimes being responsible for as much as 70 percent of a product’s success. And yet, companies generally spend only 2 to 10 percent of their total marketing budget on these stakeholders.

Certainly many companies have a market access team, but it rarely includes individuals from across the organization. To have a constructive conversation with payers, companies must create a cross-functional market-access team comprised of individuals from R&D, sales and marketing, and medical affairs. This team should begin a dialogue with payers and HTA agencies early and then keep them apprised of the decisions made throughout the R&D process. The team should especially communicate the type of patient populations that are being targeted and the expected benefits. Such a dialogue will also give payers and HTA agencies the opportunity to provide guidance on the kind of efficacy and safety data they would be looking for, which would help companies define more targeted clinical studies.

Change the Game with Innovative Pricing

Price increases have been a major driver of growth for pharmaceutical companies, accounting for 65 percent of industry growth worldwide and even more in the US But although the industry has relied heavily on price increases, it has not used pricing as a tool for gaining competitive advantage. Rather, pharmaceutical companies have typically established a price range for a new product, and only if payers pushed back, or if competitive pressure forced a reevaluation, did companies get creative.

Nowadays, companies should study innovative pricing strategies during product development and make pricing a core pillar of the product’s profile.

Innovative pricing is often critical to gaining market access and receiving reimbursement. Increasingly, payers are worried about the size and the predictability of their budgets. They are more likely to approve reimbursement if a therapy can guarantee certain treatment successes or outcomes. Evidence-based pricing agreements, which may offer a payer rebate or a patient refund, are still low in volume but growing. In 2010, they accounted for 8 percent of total pharmaceutical sales in the UK, but they are growing at an annual rate of 15 percent worldwide. Even higher rates are seen in certain therapeutic areas, such as oncology and immunology. Payers look favorably on these agreements because they discourage excessive or off-label usage.

Engage and Connect with All Stakeholders

The traditional pharmaceutical selling model focused on a single channel: the physician. That narrow focus no longer makes sense in a world where myriad stakeholders exert significant influence over prescribing decisions.

Although many companies have expanded their customer-facing team to include medical science liaisons (MSLs), key account managers (KAMs), field-based access teams, and sales reps, most still struggle to maximize the value of this more complex market investment.

A consistent challenge is getting a comprehensive view of which stakeholders matter the most, who is connected to whom, and who has influence across the stakeholder network. BCG has successfully deployed social-network analysis to visualize stakeholder networks and define the most effective ways to engage with the key players. Social-network analysis helps companies answer questions such as, which institutions or individuals – for example, key opinion leaders, payers, HTA agencies, guideline committees, or physician and patient groups – are the most influential across stakeholder groups? How does information flow in the stakeholder network? And what are the most effective ways of conveying messages to the stakeholder network given the patterns of influence and communication?

When the most influential or connected stakeholders are identified, a cross-functional stakeholder-engagement plan is developed that defines the deployment of resources, outlines the roles of the various customer-facing functions, sets forth a concrete program of actions for approaching the stakeholders in a coordinated way, and details a way to measure the impact of key messages.

Measure, Measure, Measure

Collecting the right information and harnessing it is critical at every step of a product’s launch. Sophisticated analysis is required to help teams figure out what is working and what is not. Currently, most companies collect launch data in an uncoordinated fashion, analyze KPIs that track past events and actions, and then take several months to compile the data. This approach makes rapid response to the current market impossible. Instead, launch teams need to create a comprehensive system that tracks KPIs in real time, enabling companies to understand what is happening in the marketplace and to make necessary adjustments quickly and effectively.

Biopharma companies could learn a thing or two from consumer products companies. These organizations have measured with great accuracy the impact that various marketing tools – such as promotions, coupons, and advertisements – have on their business. By contrast, pharmaceutical companies gather much detail on the recruitment, training, and effectiveness of sales reps.

Companies have failed to dig deeper and analyze the extent to which other elements of their marketing efforts—such as collateral materials, medical education, disease management programs, and conventions – are effectively communicating their message. Analyzing the impact of these elements is complex and challenging. But if it is done well, it can help companies create the optimal mix of tools and reduce spending overall – a savings that can be reinvested in activities that more effectively drive future success.

Prepare to Pursue Alternate Routes

In the past, investment levels for a new launch were more predictable. The rule was to spend aggressively for the launch and for a few years after and then to let spending decline as a product aged. In an environment where it is difficult for companies to predict whether they will gain market access and be approved for reimbursement, and where competitors are responding to new market entrants much more quickly, sticking to one strategy is a sure-fire way for getting out-maneuvered. Having a plan B that’s only a slight variation is no better. Rather, investment strategies need to be dynamic and adapt to the realities of the marketplace. When it is apparent plan A is not working, companies need to shift gears and quickly pursue previously mapped out alternate routes.

Sticking to one strategy is a sure-fire way for getting outmaneuvered

The new reality of the pharmaceutical marketplace is one of increasing complexity, mounting uncertainty, and intense competition. These challenges stem from a host of pressures, including declining R&D productivity, increasingly crowded markets, and high market-access and reimbursement hurdles. As a result, a new product’s success or failure hinges on the effectiveness of the launch and is judged by the market more quickly than ever before. Therefore, it is imperative that pharmaceutical companies employ a comprehensive launch strategy: one that coordinates all functions across the organization and drives decisions from the preparation phase through rollout.

These new tactics can reduce the budget for marketing a big film and more effectively build a movie’s fan base well ahead of opening weekend. Certainly the stakes are much higher when it comes to life-saving medical treatments. But like their Hollywood counterparts, pharmaceutical launch managers must rewrite their go-to-market rules one launch at a time.